3 Common Causes of Insurance Claim Denials and How to Avoid Them

The expression “garbage in, garbage out” or “gigo” is generally used in IT field that means regardless of how accurate a program’s logic is, the results will be incorrect if the input is invalid. The same applies for medical billing process… if you have the wrong information about patient’s coverage or even incorrect patient demographics, you are risking claim denial or rejection, no matter how good your EHR or your coding is.

Listed below are 3 frequent causes of claim denials and rejections for Medical Offices and Outpatient Surgery Centers (e.g. Medicare Denial Codes CO-22 , CO-120, CO-24):

a) Outdated information about patient’s Payer Coverage (e.g. Medicare patient switching to Medicare Advantage plan or Medicare patient’s SNF episode or Hospice status, or HMO patient changing their IPA/Medical Group)

b) Incorrect insurance related information or patient demographics (such as incorrect Member ID or name, DOB)

c) Lack of Pre-certification / Pre-authorization or referral (HMO patient)

Sometimes patients will make an appointment with a provider and tell the front office “I have Medicare” when in reality, Medicare might be their secondary payer. This happens when patients are still working (beyond age 65) and have medical insurance coverage from their employer. In that situation, the Medicare coverage offered by their employer becomes Primary and Medicare becomes secondary. However, many patients simply assume that Medicare is their main payer. If you do not verify eligibility and confirm this information, you may end of losing money on the claim since until you bill and collect from the primary payer, Medicare will not pay. You can appeal the claim denial but based on their policies, you may run into issues including timely filing limits.

Many EHR/Billing systems that have good built-in denial management tools will tell you when and why a claim was denied or rejected and let you correct and resubmit the claim. However, working on correcting claim errors is expensive and there is no guarantee that you will get paid eventually. For example, if a patient switched from traditional Medicare coverage to a Medicare Advantage (MA) plan, unless you are contracted with that Medicare HMO Plan and you had gotten prior authorization (if required) prior to patient’s visit, your claim may be denied.

Ways to avoid such Coverage-related Claim Denials

These insurance-related denials can be avoided if the front office performs thorough patient’s eligibility and benefits verification prior to their visit. Many practices use combination of manual, phone based verification and Web-based Verification using Payer Portals. But this option is getting expensive due to the labor costs involved and due to complexity of maintaining login credentials to various payer portals. Some Practices utilize integrated eligibility verification tools within their EHR/PM Systems. However, this solution falls short due to the fact that the eligibility information returned by the payers via standard EDI transactions runs into many pages and the key information may be hidden in one of those pages. To solve this issue of ‘things falling through cracks’, some practices outsource their front-end eligibility verification process to a third-party such a medical billing company.

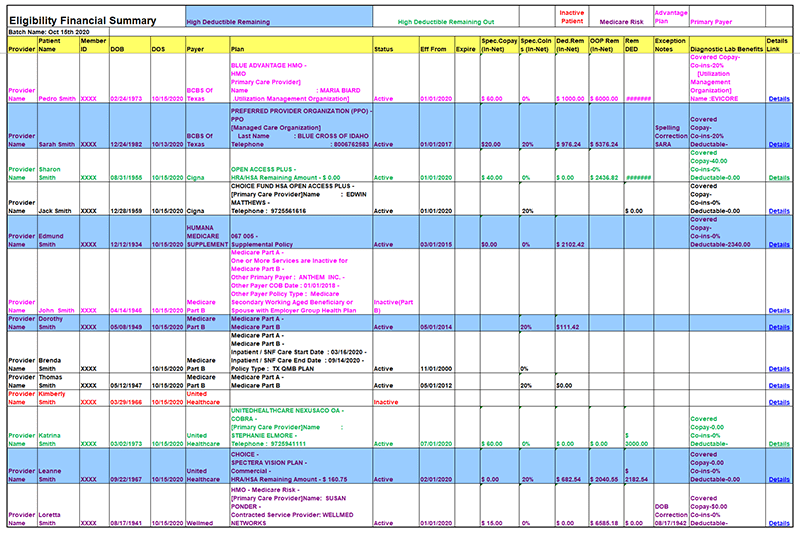

A far more cost effective option is to consider solution providers such as pVerify who specialize in providing customized eligibility solution employing a blended approach of advanced EDI technology coupled with proprietary manual workflow to guarantee complete (including deductible remaining, OOP info) and contextual (specific to your specialty) eligibility and benefits information. pVerify provides front-office personnel a sure-fire method of identifying patients with insurance-related issues by delivering an innovative, Microsoft Excel based, color-coded Eligibility Summary Report.

These eligibility Summary Reports highlight key eligibility and benefits information about each patient scheduled for a given Date-of-service (DOS). Each row represents a patient, and each column has benefits data.

This allows the front office to identify patients whose primary payer has changed or those with expired coverage and even those patients where the demographics information is incorrect. pVerify solution leads to increase in “clean claims” and can dramatically reduce A/R and increase cashflow.

We hope that the above information has been helpful and your medical practice will no longer be weighed down by bad debts.

If your practice needs a one-stop automated solution for complete real-time and batch verification of patient eligibility, determination of patient obligation, and facilitation of payment to stop the bleeding caused by:

- Unpaid post-visit patient balances.

- Claim rejections due to patient eligibility errors.

- Denials due to billing the wrong payer.

- Staff expenses for verification and collection.

- Payer reimbursement issues.